As an investor, you are constantly looking for ways to maximize your returns and make more money. With the rise of artificial intelligence (AI), you now have access to a powerful tool in SparkTrade.io that can help you make better investment decisions.

Why is AI-driven stock picking consistently better than human-driven stock picking?

SparkTrade.io (AI) can process vast amounts of data much faster than humans. Stock market data is constantly changing, and keeping up with it can be overwhelming. AI algorithms can quickly analyze data from various sources, including financial statements, news articles, and social media, to identify trends and make predictions. This ability to process large amounts of information in real-time gives SparkTrade.io a significant advantage over humans.

How can you use AI to your advantage?

AI algorithms can make unbiased investment decisions. Emotions and personal biases  often play a significant role in human-driven stock picking, which can lead to impulsive and irrational decisions. SparkTrade.io, on the other hand, make decisions based on data and logic, free from personal biases. This eliminates the potential for human error, making AI-driven stock picking more reliable and consistent.

often play a significant role in human-driven stock picking, which can lead to impulsive and irrational decisions. SparkTrade.io, on the other hand, make decisions based on data and logic, free from personal biases. This eliminates the potential for human error, making AI-driven stock picking more reliable and consistent.

Another benefit of AI-driven stock picking with SparkTrade.io is that it can reduce the risk of making bad investment decisions. AI algorithms can identify patterns and predict market trends with a high degree of accuracy. This helps you avoid making costly mistakes and reduces your exposure to risk.

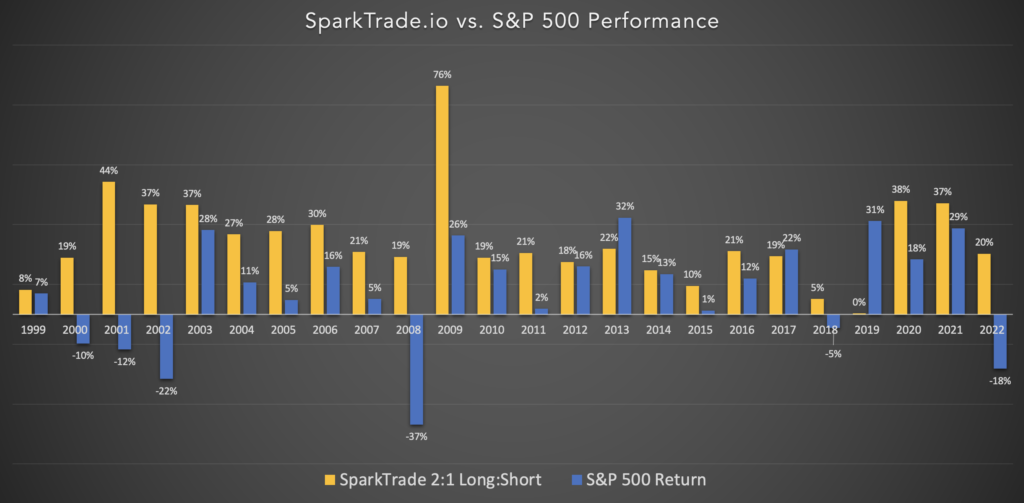

The SparkTrade.io 2:1 Long:Short portfolio, which has a few trades each day, substantially outperformed the S&P between 1999-2022. During this period, the S&P had a compound annual growth rate (“CAGR”) of 6.72% and SparkTrade’s 2:1 Long:Short portfolio had a CAGR of 25.13%.

Emotional trading leads to losses.

SparkTrade.io’s AI is not affected by emotions and is immune to the distractions and stress that come with making investment decisions. AI algorithms can remain focused and continue to make rational decisions even in the face of market volatility. This helps you maintain a long-term investment strategy, rather than making impulsive decisions based on short-term market fluctuations.

Best of all, it’s not hard to use!

SparkTrade.io’s AI-driven stock picking is a powerful tool that offers many benefits over human-driven stock picking. By using SparkTrade.io, you can access vast amounts of data, make unbiased investment decisions, reduce risk, and maintain a long-term investment strategy. Whether you are a seasoned investor or just starting out, incorporating SparkTrade.io’s AI into your investment strategy can help you outperform typical emotional traders.